Case Studies

BUSINESS TURNAROUND

Background

A 133-year old business originally a friendly society delivering health benefits to its members decided in 2014 to demutualise, depart from health, sell its assets and to pursue residential property development. By 2020 after 6 years as a public company property developer the business had not completed a project, nor generated any revenue and had accumulated around $20m in losses.

Solution

In order to restore profitability and provide a return to shareholders a complete operational transformation was undertaken over 12 months. Concurrently at a corporate level considerable disruption through numerous shareholder actions seeking board spill and wind up.

- Remove fixed cost inefficiencies and outsourced business operations to incentivised specialists, generating 37% in overhead cost savings.

- Redirected real estate marketing campaigns to targeted release creating high demand rather than a saturated on-completion sales process, generated a revenue uplift of 17%.

- Abandoning multi-residential development and pursuing vacant land sale and subdivision so as to capitalise on the immediate post-covid demand, generated a 20% profit from a previous loss position.

- Rather than acquire overpriced development land and ride it out, increased funds under management from $2.8m to $22.4m, improving investment earnings by 152%.

Portfolio Activation

Background

Lei Shing Hong (LSH) is a privately-owned international conglomerate based in Hong Kong with more than 300 regional offices, serving 11 markets worldwide across automotive, machinery, shipping, financial services and property. LSH Property Australia was established in 2015 to extend the significant global property development business and portfolio of retained assets.

Solution

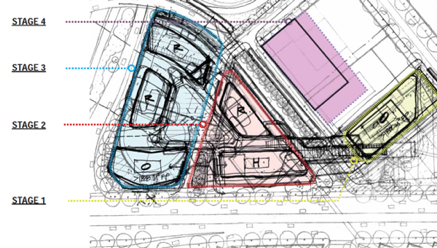

A unique strategy was developed, labelled Get Going In 2020: A Collaboration that Provides the Strategic, Technical and Commercial Expertise to Activate LSH Property Development Projects.

- A portfolio rather than individual strategy to deliver generational annuity, whereby assets and potential acquisitions are optimised by diluting the reliance on the automotive industry whilst maintaining its brand importance through developing large scale branded mixed use precincts.

- Concept development, external stakeholder collaboration and detailed financial scenario analysis to underpin business case submissions and development activation strategies designed to mitigate potential post-COVID construction cost escalation.

Outcome

Project specific business case assessments have proven strategies that can activate in excess of $2B in developed property nationally, by 2030.

Turnaround Management

Background

APM Group was a debt-free $110M revenue mid-tier commercial construction contractor, and in addition a joint venture partner in a $70M project.

Problem

Two years post-GFC and pent-up financial distress and numerous subcontractor insolvencies had wiped out APM’s retained earnings account and pushed the business to its first ever loss via 6 distressed projects.

Solution

An aggressive turnaround management strategy in order to meet contractual obligations, protect livelihoods, bring surety to the joint venture business, restore cash flow and avoid insolvency-

- Explained to internal people what was in it for them and in turn, how that will add value to the business

- Detailed what success looked like by when to external stakeholders and partnered with them in that plan

- Deployed the executive leadership team to projects so as to manage coalface performance, external stakeholder expectations and commercial and contractual obligations.

- Reset delegated authorities and internal commercial disciplines so as to manage cash flows daily.

- Reduced fixed overheads and realised property assets.

- Constant performance-based communication leveraging our success as the motivation for effort.

- As banks were unapproachable, secured a $1.5M high net worth short term cash advance.

Outcome

A $7M cash turnaround was achieved in 9months without any external professional services. No liquidated damages imposed. Short-term debt repaid. Joint Venture relationship maintained. Reputation enhanced through turnaround success enabling 80% of future revenues secured prior to that financial year.

Cost Recovery

Background

Lei Shing Hong (LSH) is an international conglomerate with five core businesses in automobile, machinery & equipment, property investment & development, trading and financial services. They are one of the world’s largest Mercedes-Benz and Caterpillar dealers and are a global property developer.

Problem

Two major development projects in excess of combined $180M were suffering time and cost distress and in both cases head contractors were threatening formal dispute amounting to $14M on one project and $3M on the other.

Solution

Detailed contractual interrogation and commercial scenario modelling in order to enable negotiation, or worst case, provide appropriate justification for a legal process-

- Assemble an independent team of time, cost and legal experts to undertake forensic analysis

- Test a litigation strategy firstly in order to quantify and populate any evidence gap

- Financial scenario modelling of potential outcomes through negotiation and litigation strategies

Outcome

One project was successfully negotiated on behalf of LSH securing the full $3M cost recovery without any formal dispute process. The other project had commenced the contractual dispute process yet cost recovery of $8M was justified to enable executive level negotiation.

Expansion Strategy

Background

Global Student Accommodation (GSA) is a UK-based property developer and investor that has operated in excess of 60,000 beds under various brands across 3 continents and collaborates with 100 universities worldwide. It entered the Australian market in 2016.

Problem

An under-resourced business that was initially focused on acquisition did not have the local relationships to enable it to continue to build a development pipeline and convert to construction.

Solution

Activate a pipeline of projects and to establish process improvement through a national project risk advisory role-

- A local procurement strategy created a panel of preferred project partners commensurate with the specific GSA offerings, location and risk profile enabling cost surety, product consistency and project performance management.

- A project risk management discipline whereby consistent metrics and reporting would link acquisition to construction bringing surety to development forecasts.

- An offshore procurement strategy whereby an overseas supply chain was secured to increase end value through cost efficiency and delivery certainty.

- An operational role providing oversight to live construction projects from procurement and contract negotiation, through consultant performance, to practical completion.

Outcome

A development pipeline in excess of $300M was activated, delivering more than 2,000 student accommodation beds across Melbourne, Perth and Adelaide.

Structured Exit

Background

Arrow Constructions Australia (ACA) was a $40M revenue small commercial construction business owned by Arrow International, a $400M tier1 New Zealand contractor.

Problem

As a Non-Executive Director engaged to design a business transformation strategy of the loss-making ACA business, inaccurate business forecasting and a sustained history of losses led to solvency concerns.

Solution

Having resigned as a Director and undertaken a detailed financial analysis a potential $14M risk to the business owners was likely should ACA be unable to meet its

contractual obligations-

- Designed an exit strategy withdrawing from recently awarded yet to commence unprofitable projects

- Replaced the majority of staff from existing projects, all of which were also loss-making

- Continued to share the business’ exit strategy with external stakeholders on a ‘no surprises’ basis

- Re-negotiated supply chain and subcontractor ‘payment for performance’ relationships

- Respectfully exited redundant staff, reduced and then shifted fixed overhead costs back to NZ

- Collaborated with the construction union on an industrial relations strategy

- Partnered with legal counsel to negotiate and / or litigate in excess of 9 contractual issues.

Outcome

Completed all projects and paid out all obligations over 9 months, reducing losses to $6M after having an $8M ParentCo Guarantee released and despite a further $1M debtor default.

Joint Venture

Background

APM Group was a medium enterprise commercial construction contractor with annual revenue of $110M.

Problem

Now that the business had grown successfully to this level without debt, its ability to continue to grow would be limited by its ability to provide high value project securities and larger volumes of working capital.

Solution

Seek a transaction with a larger contractor who has a track record in a similar sector in the industry, is prepared to engage in a commercial partnership and has the financial capacity to carry mutual expansion-

- Undertake a joint venture or specific project partnership as a ‘try before buy’ proposition

- Target project capability in the next level up so a greater market share is possible

- Seek a partner outside of the incumbent market that is looking for geographic expansion

- Ensure a similar culture of developing people to optimise business performance

- Secure counterparty agreement to support 100% of project security requirements

Outcome

A 50:50 joint venture was executed with Broad Constructions a $400M revenue national contractor and subsidiary of public company Leighton Contractors (now CPB and in turn CIMIC). The joint venture produced $250M in profitable revenue over 3-years before a change in Leighton majority ownership incorporated the JV into one of its Broad entities.

Exponential Growth

Background

APM Group was a small to medium enterprise construction company specialising in interior fit-out projects, employing around 30 staff and producing annual revenue of $34M.

Problem

To generate considerable retained earnings in order to sustain future growth, without taking on debt.

Solution

A structured plan whereby incremental revenues would support exponential growth-

- To enable a transition to larger profit margins a business development strategy whereby five business as usual projects would support one next level larger project annually, rather than scattergun revenue chasing.

- In line with scaling up, an incremental people development strategy whereby complementary outsourced skills would enhance rather than undermine current capability.

- Expanded our interior fit-out capability to predominantly out of the ground multi-level construction projects and promoted our ability to offer quality in addition to quantity.

- Risk and Governance became a focus whereby a specific and structured management reporting regime focused on whole of business risk and opportunity as opposed to simply construction project margin reporting.

- Capital growth strategies through marketing cash reserves for a more competitive supply chain outcome and through converting retained earnings into high yielding deposits.

Outcome

Revenue growth of circa 30% per annum average over 4 years producing revenue of $110M, doubling the amount of profit, increasing retained earnings 8x and nett cash flows 10x, and maintaining a debt-free position.

Global Expansion

Background

Human Recognition Systems (HRS) is a UK-based biometric technology business specialising in automated systems for site access, passenger validation and identity management solutions.

Problem

Whilst there is demand for people management biometric technology HRS do not have resources nor relationships outside of Europe in order to contemplate an Asia-Pacific expansion on the other side of the world.

Solution

Undertake customer demand and product analysis and prove up a expansion business case-

- Immerse in the UK business to understand technology and application.

- An Asia-Pacific competitor product analysis of workforce access and identity management across airports, mining facilities and construction sites.

- Lobby major employer and employee organisations, engage with major airport passenger terminals and seek partnership interest from tier1 construction and mining contractors.

- Understand competing technologies and the variances in legislated data privacy regulations across different locations.

- Quantify contractual parameters and financial metrics around potential partnerships in technology, installation and support.

Outcome

A detailed product analysis revealed that construction workforce management will endure industrial relations issues, mining facility installations are already well advanced, and there will be a future in passenger terminal identity management. Pending project.

Global Procurement

Background

Global Student Accommodation (GSA) is a UK-based property developer and investor that has operated in excess of 60,000 beds under various brands across 3 continents and collaborates with 100 universities worldwide.

Problem

Whilst construction was the largest cost component in the GSA development value chain, and their strategy at the time was to create 250,000 beds by 2025 there was no connection between the various GSA business units in terms of establishing procurement efficiencies.

Solution

Create a global procurement strategy so that transaction scale will not only underpin development feasibility through cost savings but also bring surety to GSA’s product offering via ongoing investment in innovation-

- Connect all the business units across Europe, Middle East and ASIA-Pacific and unpack their different product offerings and specific supply chain relationships.

- Establish a minimum viable product in terms of those outsourced items that will consistently align across business units with respect to culturally sensitive contracting and delivery models.

- Engage with global partners that demonstrate innovation and an ability to produce, distribute and warrant performance at scale.

Outcome

In addition to authentic face to face global collaboration across cultural differences, a quantifiable strategy producing $60M in entry level cost benefit over a 10-year period.